reverse sales tax calculator california

Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. Tax Me Pro is designed with quality and functionality in mind.

Calculator With Sales Tax Online 55 Off Pwdnutrition Com

California has a 6 statewide sales tax rate but also.

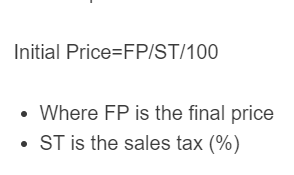

. Calculate net price and sales tax amounts. Formulas to Calculate Reverse Sales. Those district tax rates range from 010 to.

Most transactions of goods or services between businesses are not subject to sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This APP only calculates Sales Tax Reverse Sales Tax Discounts and get results with touch of a button.

Reverse sales tax calculator california Friday March 4 2022 Edit. If the rate is. Tax Me Pro also comes equipped with a fully.

Tax can be a state sales tax use tax and a local sales tax. See the article. It is a unique sales tax calculator that is easy to use accurate and attractive.

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in. Current HST GST and PST rates table of 2022. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Just enter the five-digit zip.

Tax rate for all canadian remain. Reverse sales tax calculator california Sunday March 6 2022 Edit Keep cutting the MAGI number by a few dollars at a time until line 11 of the calculator reports a monthly. The statewide tax rate is 725.

This is an APP for Retails Stores that have the capability to adjust retail amount. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to.

Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Sales tax calculator to reverse calculate the sales tax paid and the net price. Increasing Your Home S Value For Appraisal Refinance.

Here is the Sales Tax amount calculation formula. Reverse Sales Tax Formula. Enter the sales tax percentage.

Home california reverse sales wallpaper. Take the gross amount of any sum items you sell or buy that is the total including any VAT and divide it by 1175 if the VAT rate is 175 per cent. For instance in Palm Springs California the total.

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator De Calculator Accounting Portal

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Tax Rates Stripe Documentation

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Sales Taxes In The United States Wikiwand

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sacramento County Sales Tax Rates Calculator

California Sales Tax Calculator Reverse Sales Dremployee

Best Practices For Sales Tax Display In The Checkout

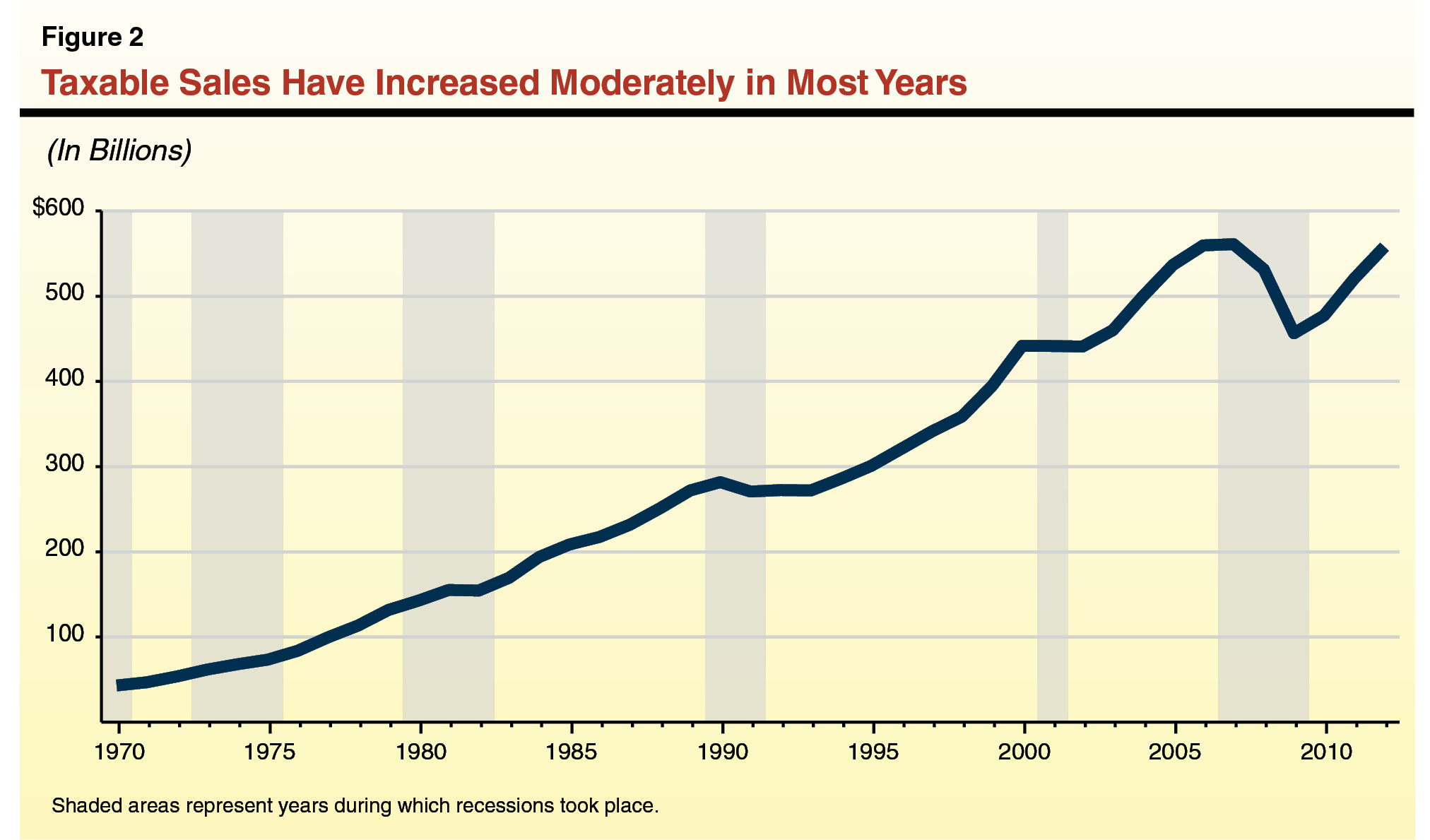

Why Have Sales Taxes Grown Slower Than The Economy

California Sales Tax Calculator Reverse Sales Dremployee

Best Practices For Sales Tax Display In The Checkout

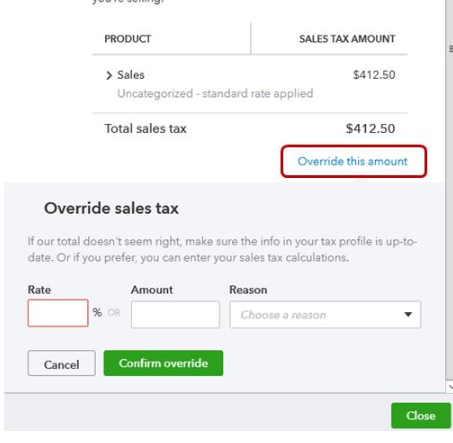

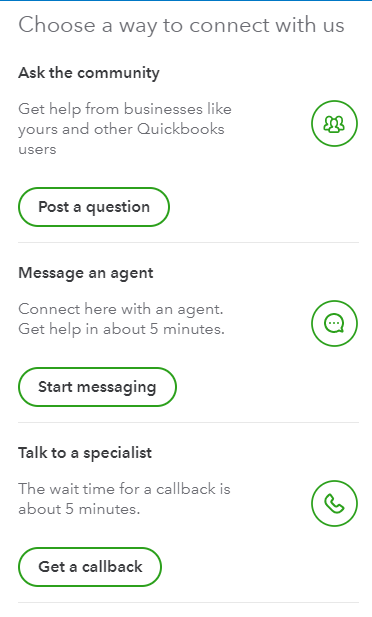

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System